Planning for the futre of the US

The Recent History of Rare Earth Elements

The $13 billion global rare earth market is growing

at 10.8% per annum according to Global Market Insight

Inc., as demand for electric vehicles, cellphones and

other products rise. Since 1988, China has been the

dominant supplier of REEs. In 2011, China provided 95%

of the global market and decided to restrict exports and

favor its own domestic industries—a decision that

resulted in REE price volatility. Consequently, rising

concern among industrialized nations has revitalized global

interest in REE mineral exploration and extraction.

Worldwide, several new commercial REE projects,

in various stages of planning and development, are

focused on diversifying supply; however, new efforts to

purify and refine REEs remain limited.

In 2009, intensified interest in strategic materials

culminated in discussions regarding our nation’s ability to

secure reliable supplies of REEs and other strategic

materials.

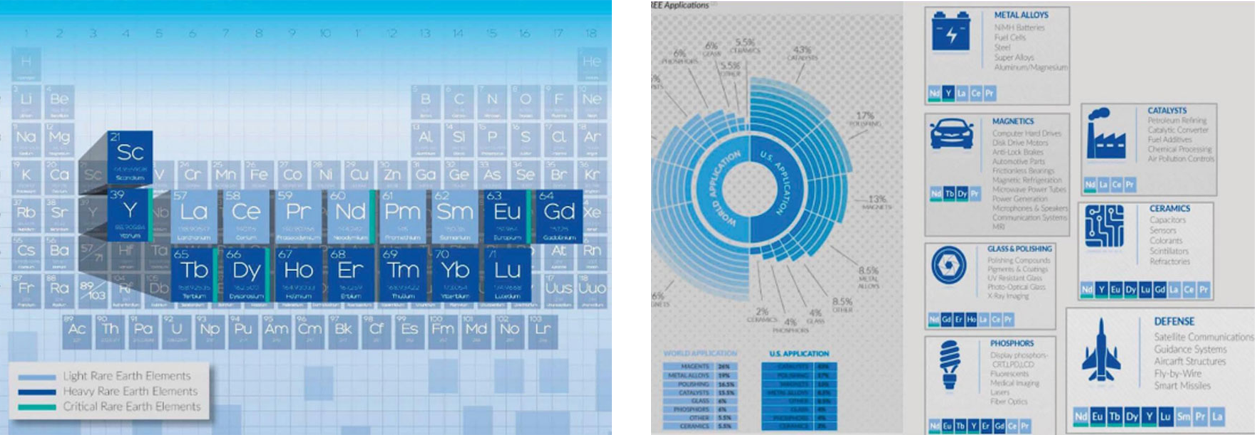

Strategic materials were identified as critical for

growing the U.S. green energy and electronics

industries, as well as for specialty military applications.

In response, DOE released the first Critical Materials

Strategy in 2010, identifying ytirium(Y), neodymium

(Nd), europium (Eu), terbium (Tb) and dysprosium (Dy)

as critical REEs.

Nationally, Congress appropriated funding in 2014

to explore how the US can produce more REEs,

recognizing the importance of this resource to U.S.

economic security, In December 2017, President Donald

Trump signed an executive order to create a federal

critical minerals strategy, which would cut red tape and

boost resources for exploration.

In January 2020, Canada and the US signed a Joint

Action Plan on Critical Minerals Collaboration, aimed to

advance the countries’ mutual interest in securing supply

chains. In April, the Rare Earth Element Advanced Coal

Technologies Act was introduced, which would allocate

$23 million a year to the Department of Energy and its

National Energy Technology Laboratory (NETL) through

2027 to help de- velop technologies that could extract

rare earth elements from coal and coal by-products in

U.S. mines.

Local industry groups in Central Appalachian coal

region including the DCL principals, launched R&D efforts

to identify and locate domestic reserves containing

elevated REE concentrations in coal and coal-related

materials.

They also began to explore commercial and novel transformational REE separation and extraction concepts,

and to address REE separation technology performance

and process economics.